Previous Story

What is Bitcoin?

If you are an internet user, you might have heard a lot about Bitcoin. While some call it “rat poison,” others believe it is “hope”. Statutory bodies like the Internal Revenue Service (IRS) classify Bitcoin as an “asset” whereas it is considered a “legal tender” by nations like El Salvador.

After all, what is Bitcoin? Let’s uncover the mystery and discover how this ingenious piece of software turned from almost $0 to a cryptocurrency with the largest market cap in the world.

Bitcoin is the fastest way to transfer value in today’s hyperconnected era. Fundamentally, it is a virtual currency/digital asset that can be sent to any part of the world in milliseconds without any intervention from central authorities such as banks or governments.

Bitcoin was designed to be a decentralized, trustless, fully transparent, peer-to-peer payment system. Trustless, here, means that no trusted parties (like credit card companies or government agencies) are needed for Bitcoin transactions. Anyone with internet access can send/receive Bitcoins worldwide via a wallet like Speed.

All the Bitcoin transactions are powered by Blockchain — a shared, immutable ledger that records transactions.

One Bitcoin can be divided into eight decimal places; each constituent is called a “satoshi.” While Bitcoin was primarily developed to be a virtual currency, it is also a good store of value like gold. That’s because its value has increased considerably since its inception. Let’s understand how Bitcoin came into existence.

The headline “Chancellor on brink of second bailout for banks” appeared on the front page of The Times on January 3, 2009, after the financial crises in 2008. The article explained how the Chancellor was almost being forced to pump billions more into the economy — a second bailout for banks — as the lending drought worsened.

Surprisingly, that same headline was imprinted on the Genesis Block, which was released on January 3rd, 2009, by Satoshi Nakamoto — a mysterious person/group — known for the creation of Bitcoin.

Satoshi’s message inscribed on the Genesis Block demonstrates his attitude toward centralized finance. His message was clear: to cut out the corrupt and unreliable middleman from financial transactions by choosing a people-driven currency — Bitcoin.

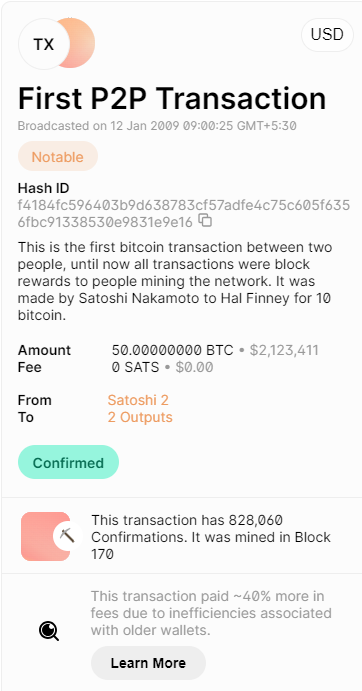

In the initial years, Bitcoin was worth nothing. On 12 January 2009, Satoshi Nakamoto, the anonymous creator of Bitcoin, transferred 10 BTC to Hal Finney, a computer scientist. It was the first P2P transaction to happen on the Blockchain.

A year later, on May 22, 2010, the first-ever real-world transaction occurred when Laszlo Hanyecz, a developer and an early Bitcoin miner, exchanged 10,000 Bitcoins for two large Papa John’s pizzas.

Later, in October 2010, Bitcoin’s price reached $0.1 and increased to $0.3 by the end of the year. Over time, Bitcoin started gaining popularity. In 2011, its value grew to $1 for the first time, and by June, its price broke another high of $29.6 per Bitcoin.

A couple of years later, in 2013, Bitcoin’s price suddenly jumped from $13 at the beginning of the year to a whopping $1000 by November 2013. From then on, it steadily grew and reached an all-time high of $64,899 by November 2021.

As of today, Bitcoin is trading at $42,788 — which is bound to exceed $50,000 in the coming m months. After all, what makes a virtual currency like Bitcoin so valuable? Let’s find out.

Just like fiat currencies, Bitcoin derives its value from trust. As long as people believe in the system, it will continue to have value. But there’s more to it.

Bitcoin and other cryptocurrencies aren’t backed by any central authority like the banks/governments in the same fashion as fiat currencies. This means the government regulations and inflation rates that affect traditional money do not have any impact on Bitcoin. Here are a few factors that influence Bitcoin’s price:

At its core, Bitcoin and other cryptocurrencies derive value from supply and demand. Other factors like production cost, competition, and regulatory developments can greatly influence its price. Just like gold, Bitcoin can be a reliable store of value. Can it be a better alternative to traditional currencies? Let’s find out.

Bitcoin shares a lot of attributes with the physical money we use today. Let’s look at the characteristics Bitcoin shares with traditional currencies:

Bitcoin inherits all the traits of fiat money. It is a widely accepted medium of exchange and can store value, like gold, and is easily transferable. Unlike fiat money, Bitcoin cannot be inflated, thanks to its limited supply. Thus, Bitcoin can be a better alternative to fiat currency.

As of writing this, there are over 200 million Bitcoin wallets worldwide. This number is steadily growing as more and more people start to value their privacy. Here are top 5 reasons you should consider using Bitcoin:

Normally, if you had to send money to someone in the US, it would at least take 2-3 days until the funds are settled. And if the money is coming from abroad, the settlement may sometimes take weeks or even longer.

One of the major advantages of cryptocurrencies is transaction speed. You can send Bitcoins to anyone living anywhere in a matter of minutes. Bitcoin makes money transfers a breeze. Moreover, the transaction processing cost for Bitcoin is significantly less than any other payment method.

Bitcoin is also considered a ‘hedge against inflation.’ Because of its limited supply, Bitcoin has had the lowest inflation rate (1.74%) since its inception. That is almost half of the long-term average inflation rate of the US dollar, which stands at 3.28% as of the time of writing this.

Transactions made via Bitcoin are private, anonymous, and fully transparent. Most Bitcoin wallets don’t require you to go through strenuous KYC processes. Thus, any transaction you make via Bitcoin remains anonymous.

As all Bitcoin transactions are stored on a publicly distributed ledger, each transaction can be traced back to its origin through Blockchain Explorer. This provides transparency and privacy to all the users transacting in Bitcoins.

You don’t need a hefty bank balance or a healthy credit score to start using Bitcoins. All you need is a Bitcoin Wallet and access to the internet to initiate Bitcoin transactions. As a decentralized currency, Bitcoin can be accessed from anywhere in the world.

Bitcoin transactions are secured cryptographically. Moreover, once a transaction is confirmed, it cannot be altered. Unlike banks and other financial institutions, Bitcoin is less vulnerable to losses due to cyber-attacks. This makes Bitcoin one of the most secure means for transferring money.

Bitcoin can be used to buy anything from luxurious cars to electronics and everything in between. Let’s look at a few real-life use cases of Bitcoin:

Bitcoin’s use cases extend far beyond the list mentioned above. It is one of the most efficient currencies of the 21st century. Bill Gates puts it best: “Bitcoin is a technological tour de force.” It has the potential to change how money works.

Bitcoin is not just a currency but a hope for the millions of unbanked citizens worldwide. It is the future of money. Its decentralized nature, transparent record-keeping, and borderless movement make it a perfect alternative to fiat money.

Whether you’re a tech enthusiast, a financial expert, or a working professional, now is the right time to embrace Bitcoin. With the government injecting billions of dollars into the economy, the day isn’t far when the millions you hold today wouldn’t be worth that much.

Sign up with Speed Wallet today and switch to a currency that never inflates. Speed levies no transaction fees on peer-to-peer transactions. Our app is available for both Android and iOS. Download now for free to experience blazing-fast transactions at zero transaction fees.